NEW INDICATOR ABOUT OFFICE METRIC PRICES IN THE GREATER PARIS REGION

To enhance transparency and clarity on the French Real Estate Market, ImmoStat is unveiling today a new indicator capitalizing on the Office transactions that are being recorded every quarter since 2005 to track the overall activity of Capital Markets in the Greater Paris Region.

This new indicator is expressed in euros per sqm « transaction costs included » and is being released with an history starting in 2005. It will be updated every quarter alongside the traditional investment amount in Commercial Real Estate.

Results for the Greater Paris Region and the 5 large geographic areas will be publicly available on www.immostat.com whereas professional subscribers will receive greater details based on sectors (Paris CBD and La Défense in particular).

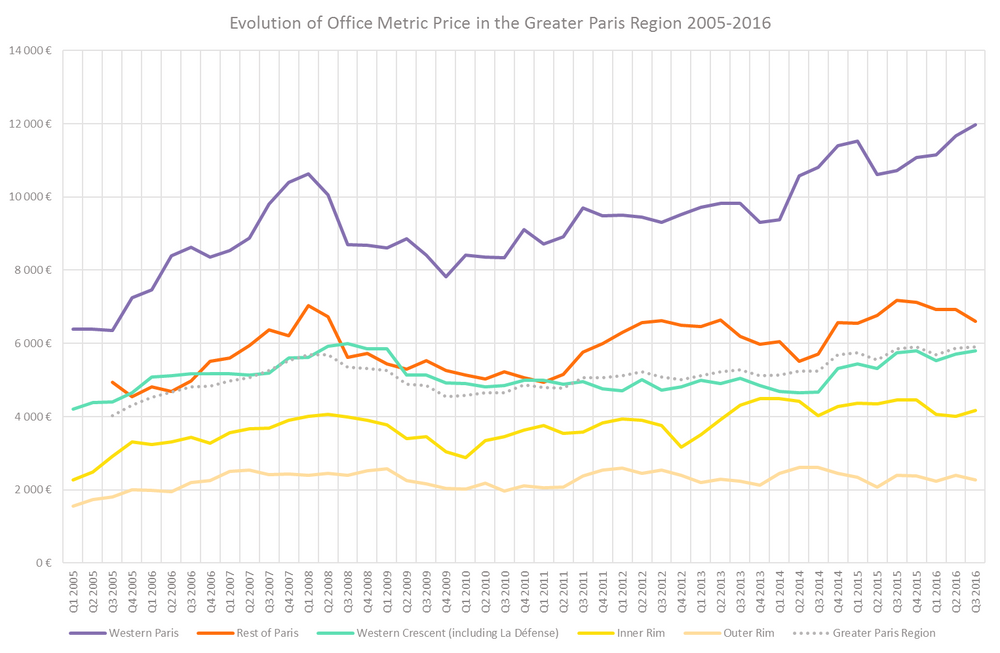

CONTRASTING TRAJECTORIES IN THE GREATER PARIS REGION

The ImmoStat indicator of metric prices shows that since Q1 2014, prices in Western Paris have grown by +28%. The maximum average metric price that occured at € 10,632€ psqm before the 2008 financial crisis is now topped by 13%.

This situation is in sharp contrast with the rest of the Paris Region: prices in both Inner et Outer Rim have remained stagnant and although prices have been growing in the Western Crescent, that have not yet surpassed the maximum that occurred in Q3 2008 at € 6,003 psqm.

Coming releases will help tracking the evolution of Office prices both on a solid basis and with greater transparency. Emerging trends will complement the analysis of yields that each ImmoStat member is carrying out separately.

METHODOLOGY

The indicator is computed as a simple average of metric prices recorded over the last twelve months, within each of the 20 ImmoStat local markets. To ensure both representativeness and confidentiality, each result is only updated if it is including at least three distinct transactions.

Local results are put together based on a predefined distribution to obtain higher level series, like the overall price in the Greater Paris Region. This method allows to avoid variations that would solely arise due to changes in the market activity profile.

It should be taken notice that the present indicator is exclusively built on Office acquisitions by investors for a nominal amount of at least 4 million euros « transaction costs included ».

More information can be found on our webpage "Market Data".